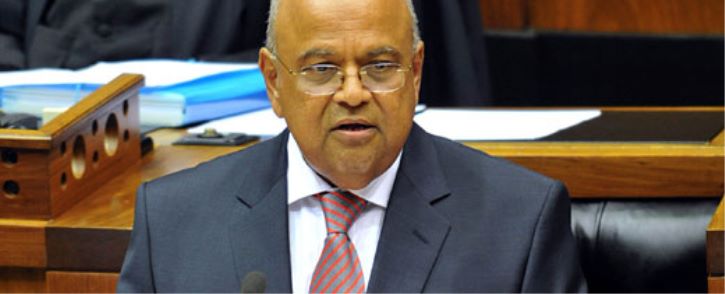

Four executives of four Gupta-owned companies ambushed Finance Minister Pravin Gordhan on PowerFM on Sunday night with questions focusing on the blacklisting of their bank accounts.

In his response, Gordhan revealed for the first time that he had met representatives of Oakbay over the banking issue and said: “Where Treasury can assist it will go out of its way to do so. We will not stand still. But we require the right kind of approaches on these kinds of matters that will find constructive solutions.”

When the fourth executive phoned in after he had given his answer, Gordhan replied: “I have indicated that a channel that existed will be activated. There are options that are not being undertaken (that can be looked at).”

South Africa’s top banks this year blacklisted Oakbay Investments and Oakbay Resources and Energy, as well as their subsidiaries Sahara, The New Age and ANN7 – and Optimum coal mine will have theirs closed soon. The banks did not give reasons for their actions, but allegations of state capture and corruption are believed to have forced the banks to cut ties due to the risks associated with these claims.

The ambush occurred at around 22:00 on Sunday, when Sahara CEO Stephan Nel, Gupta spokesperson and The New Age managing editor Gary Naidoo, Oakbay Resources and Energy CEO Jacques Roux, and one other Oakbay manager phoned in one after another to ask the same question: “What is Treasury doing to solve the banking blacklisting crisis at Oakbay?”

Gordhan, who had been discussing the effects of Britain’s decision to exit the European Union, was not pleased with the interruption.

“Four of you have now phoned,” he said. “I am surprised that you are using a talk show to resolve (your concerns).”

Responding, Gordhan said there is a confidential and contractual relationship between banks and their clients, which follows national and international banking regulations. “As a member of the G20, we as a country and the institutions within the country are obliged to abide by the rules,” he said.

Asked by Power FM host Onkgopotse Tabane whether he would engage one-on-one with an Oakbay executive live on air, Gordhan said: “I don’t want to engage. We can’t have this conversation over a talk show.

“These are matters where the world judges us,” he said. “We are a modern economy and a part of the G20 and have to get the balances right.

“With all due respect to the individuals, there is a channel of communication with Treasury,” he said.

Oakbay Investments CEO Nazeem Howa has been on countless media platforms to raise awareness that 7 500 employees will be affected by the blacklisting.

Putting those numbers into perspective, Gordhan said Treasury is here to serve the national purpose so that 55 million South Africans can have decent jobs and a better economic future.

Having failed to get any response from the banks, Howa approached the SA Reserve Bank, who referred him to the Banking Ombudsman and then National Consumer Commission, both of whom said it was outside their area of responsibility, Howa told Mineweb last week.

“We’ve made some temporary arrangements,” he said in the podcast. “We’re obviously using an international bank and that’s the way we’re having to – it’s very difficult to operate, let me be very clear about it, it’s not ideal.”

Reserve Bank governor Lesetja Kganyago in May said the regulator was unable to interfere with the relationship between a bank and its client and suggested Oakbay take legal action.

“We have a responsibility to prudentially regulate the banks, and we derive that power from the Banks Act. The Financial Intelligence Centre Act (Fica) also gives us particular responsibilities with respect to the banks and those responsibilities entail us to assess whether the banks have adequate procedures to comply with anti-money laundering and combating the financing of terrorism activities,” Kganyago said, according to a report on Gupta-owned newspaper, The New Age.

“The regulation further states that if a bank has reported a suspicious transaction to the centre, it shall not disclose such a report to anyone else,” said Kganyago.

“There is nothing I can do other than to suggest to a client who feels deprived to approach a court and enforce their rights,” said Kganyago.

Fin24 asked Treasury spokesperson Phumza Macanda late on Sunday to get clarity from the minister on what actions Treasury will take after Gordhan’s comments regarding Oakbay. We will give an update as soon as we hear back.

@Powerfm987 the callers from #Oakbay are crazy to call the show and ask the same questions.

Follow Fin24 on Twitter, Facebook, Google+ and Pinterest. 24.com encourages commentary submitted via MyNews24. Contributions of 200 words or more will be considered for publication.

[Source: News24]

WhatsApp us

WhatsApp us