Representatives of SA’s banking and financial services industry say they are finding it difficult to understand government’s rationale behind establishing a commercial state bank.

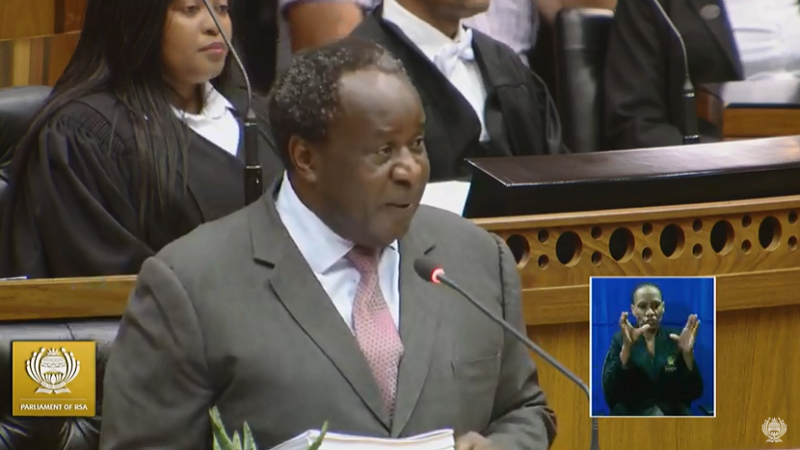

Delivering the Budget in Cape Town on Wednesday, Finance Minister Tito Mboweni said government would proceed to establish a new state bank whose “architecture will be that of a retail bank operating on commercial principles”.

“The state bank will be subject to the Banks Act, and will have an appropriate capital structure and performance parameters on investments and loan impairments,” Mboweni said, without providing a time frame.

Deputy Minister of Finance, Dr David Masondo, told journalists at a pre-Budget briefing that the state was aiming to consolidate the proliferation of “quasi” state banks, such as Postbank, into a single bank, which would be a deposit-taking institution.

Speaking to Fin24 after Mboweni’s speech, the managing director of the Banking Association of South Africa, Cas Coovadia, said the organisation still does not see a reason for the state bank. “We think it will be like other commercial banks. We think it would be better to enable commercial banks currently to address dysfunctional markets,” he said.

Mboweni said the proposed state bank would be regulated by the Prudential Authority, which operates under the jurisdiction of the SA Reserve Bank to regulate financial service providers such as insurers, banks and other financial institutions.

Old Mutual interim CEO, Ian Williamson, similarly said the “logic” behind the establishment of a state bank was not clear. “I think we have a very strong and good banking sector in SA. I am not 100% clear on what the role of the state bank will be,” he said.

Nedbank CEO, Mike Brown, said South Africa already has a developed financial services infrastructure, and the government already has a number of banking assets such as the Land Bank, the Development Bank of Southern Africa and the Public Investment Corporation.

“It is difficult to see how the creation of a state bank will be good use of government’s money in these tough times,” he said. Brown added that it was good to hear that the proposed bank would be regulated like other banks in South Africa.

Source: News24

WhatsApp us

WhatsApp us