By Daanyaal Matthews

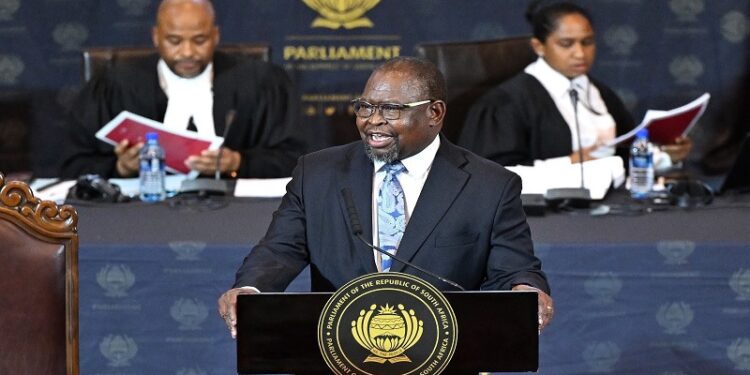

With the budget speech only minutes away, the nation waits to hear what the economic plans of the national government could turn out to be. Concerns have mounted on topics of social grants, state-owned enterprises, and taxes. The latter becomes of greater concern to individuals, as government sits in the marsh of fiscal meandering while trying to support social grants and tend to fiscal debt.

For Jurgen Eckmann, Wealth Manager at Consult by Momentum, these concerns are warranted more so for the average South African, given his analysis that the government has no choice but to increase personal tax.

“The average person’s personal income tax is being targeted. So, the average individual, such as you and me, are basically staring down the barrel of a gun when it comes to looking at some tax rate increases to kind of fund this deficit,” said Eckmann.

An increase in personal taxes is largely unexpected, primarily because such an action would hurt the same constituency that the ruling expects to garner votes from, but for Jurgen, this decision must be made regardless of it being an election year, stating:

“So, if you exclude the election year financially, the country must do it. I just don’t see any other way for them to generate more revenue. We’ll go into a couple of areas where I think we could look to boost tax efficiency. So, coming back to what I was saying, at the end of the day, they have to fund it somewhere. And even though it’s election year, it just feels like they’re going to have to make a call. Is the country going to be worse off after the budget speech and election year, or is the country going to be better off? And I think that’s kind of the situation that the minister finds himself in.”

Jurgen continued by arguing that the government can attempt to diversify income by introducing incentives, smoothing tax technology, and further investing in infrastructure.

“They could potentially consider a voluntary disclosure of previous tax errors, but without penalty. And they could just look at improving the systems that they’ve already had in place to bump up revenue. Another thing that I feel the minister could look at is innovative financing models. So if you’re looking at infrastructure, because I know that the country is going through this big drop in infrastructure and all facets of that, whether it comes to the planning or the installation and financing of infrastructure, the government could price it at marginal costs or potentially even at a loss making basis, knowing that the returns will be covered through the tax system,” added Eckmann.

VOC NEWS

Photo: ParliamentofRSA/X

WhatsApp us

WhatsApp us